How To Set Up Ach Payments For Business

Every bit your concern grows, you should always be looking to add new customer payment methods. While you may have started out by accepting only greenbacks and checks, you've probably graduated to processing credit cards. Those are not, however, your only payment options.

Your business could also benefit from setting up automated clearing firm (ACH) payments, peculiarly if y'all offering monthly subscription plans or other recurring transactions. We'll go over the ACH nuts beneath and show you the steps to go you started.

Overview: What is an ACH payment?

ACH payments are a method of directly transferring money from one banking company account to another without using checks, greenbacks, credit cards, or wire transfers. While they can exist used for one-time payments, they are more than mutual for recurring transactions.

As a consumer, automatic monthly payments that come out of your bank account for utility bills or a mortgage payment are ACH payments. So are peer-to-peer (P2P) transaction systems like Zelle.

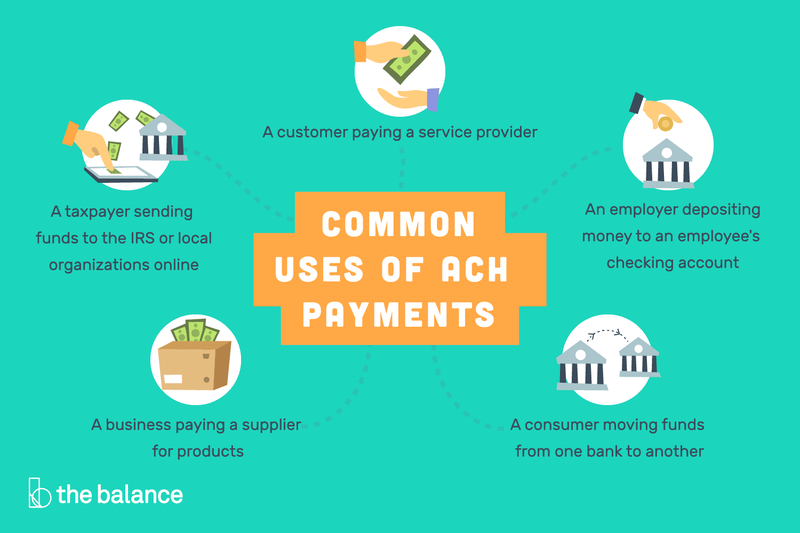

ACH payments are used in a variety of ways to directly deposit money from 1 banking company account to another.

For a business owner, paying your employees past direct deposit is some other instance of using ACH payments. In essence, each ACH deposit and credit functions as an electronic "check."

How ACH payments work

ACH consumer payments employ a four-stride process:

- Client dominance: A consumer authorizes directly payments from their bank account at a company's website.

- Transaction initiated: A business sends payment details to its bank or ACH provider, known equally the Originating Depository Financial Institution (ODFI).

- Payment requested: The ODFI's request for payment is routed to the customer's banking company, known equally the Receiving Depository Financial Establishment (RDFI).

- Payment candy: The RDFI checks that at that place are sufficient funds in the account to make payment and, if and then, processes it.

ACH payments vs. wire transfers vs. EFT payments: What's the departure?

ACH transactions are a subset of electronic funds transfer (EFT) payments, which encompass a wide range of financial processes to road money directly from one bank business relationship to some other. These include debit cards, ATMs, wire transfers, electronic checks, and pay-by-phone transaction systems.

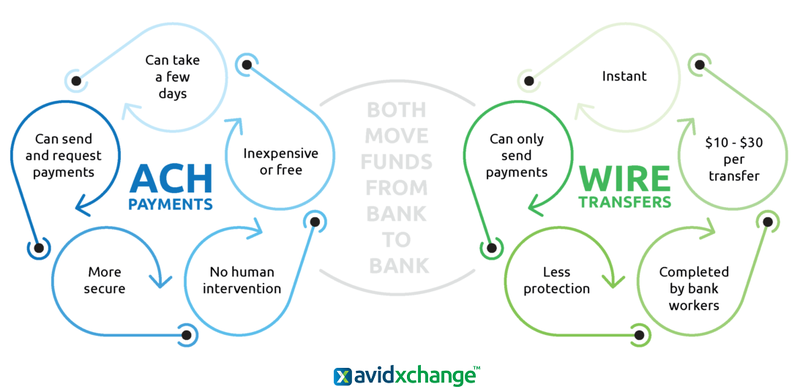

ACH payments and wire transfers are significantly different even though both electronically transfer money from one bank business relationship to some other.

There are fundamental differences between ACH transactions and wire transfers despite both being EFT payments. While ACH transactions can be used to both send and receive coin, wire transfers can only send funds.

Plus, ACH payments do not require any human input, only bank employees will manually complete wire transfers. ACH payments are also designed for transactions typically under $five,000, while wire transfers can be used for well-nigh any amount.

How to take ACH payments in your pocket-size business organization

While accepting ACH payments, peculiarly for recurring purchases, can increase your revenue, the transaction procedure is completely dissever from that of credit cards. You'll need to be aware of the specific requirements for ACH payments before incorporating it into your sales direction operations.

Step i: Determine feasibility

While greenbacks, checks, and credit cards are suitable for about all customer payments, the same is not truthful for ACH payments. For example, ACH payments work only within the United States, and then if a bulk of your business is international, you won't be able to use this process to its maximum benefit.

Tips for determining feasibility

In addition to geographic restrictions, in that location are a couple of other considerations to continue in heed relating to your client base and types of sales.

- Customers: Practise you already have customers you're billing on a recurring ground or they could be gear up that fashion? Do you serve a demographic that does non apply credit cards?

- Types of transactions: Are you already treatment a lot of paper checks? Practise you process business concern-to-business (B2B) transactions? Are you processing credit card payments that could be converted to ACH check payments with lower transaction fees?

Stride two: Choose an ACH provider

First, check with your banking company to see if they provide ACH transaction support. If they do, compare their rates to third-party ACH handlers. If you're already using a third-party provider for credit carte du jour processing, ask if they can practice these transactions also.

Tips for choosing an ACH provider

As ever, you'll desire to make sure yous don't necktie yourself into a long-term contract for your ACH payments, and that the costs and benefits are clearly stated.

- Know the fees: All your ACH fees will be separate from whatsoever current credit card processing. In particular, find out what the chargeback and non-sufficient funds (NSF) fees volition exist and if you will have to pay extra for transactions over a certain amount.

- Ease of use: Make certain the process to fix an ACH debit is easy for both you and your customers. In addition, double-check the amount of online documentation and customer support as well as reviews of each provider'southward customer service skills.

Pace 3: Set up up an ACH merchant account

Even if you already have a merchant account for credit card sales, you'll accept to set up a separate account for ACH payments. This should not be an onerous corporeality of work to keep track of, only it is some other financial asset you'll have to monitor.

Tips for setting up an ACH merchant business relationship

If yous're not currently processing credit carte du jour sales, you'll desire to choose one of the best point-of-sale (POS) systems that volition likewise allow you to create a second account for ACH transactions.

- Take the correct documentation: You'll need to provide your certificate of incorporation; whatsoever other local documents every bit required by your jurisdiction identifying company directors and owners; a utility pecker, lease agreement, or bank argument with a corporate name that identifies the company's location; and copies of valid identification for company directors and owners.

- Recurring billing: Many ACH providers offer recurring billing as a costless option, but some exercise non. Make sure yous choose one that is gratis because this is the primary entreatment of and application for ACH payments.

Step 4: Choose your ACH payment methods

While the typical recurring ACH withdrawal will exist fix and executed online, that doesn't have to exclusively be the example. That'south why y'all'll want to know all the available payment options and how to incorporate them into your sales mix.

Tips for choosing your ACH payment methods

You don't need to catechumen every sale to an ACH transaction, but where appropriate, consider the following options.

- Bank check scanner: This POS hardware will allow you to process checks without having to physically deposit them.

- Virtual last : Key in mail order and telephone social club (MOTO) payment data on your computer.

- Website payments: Encourage ACH transactions at your website for even i-off sales. Sure, you'll accept to prod customers to wait up their account and routing information, but this is a better option for you. That'southward considering a $100 PayPal payment, for example, costs effectually $iii to process, but an ACH electronic debit can cost every bit little as $0.20.

Pace 5: Avoid unwanted costs

The devil is always in the details, and whatever the topline ACH processing fees are, you want to avoid all unnecessary addition fees or penalties.

Tips for avoiding unwanted costs

NSF and chargeback fees can quickly ding your lesser line, so y'all'll need to look at your ACH account statement regularly to make sure they're not occurring too often.

- Check guarantee/verification: This service volition cost extra merely should easily pay for itself over time.

- Chargeback protection : Sure, chargebacks exist to protect consumers, merely that doesn't eliminate the possibility of your being the victim of fraud. Make sure your ACH provider has a Payment Card Industry Data Security Standard (PCI DSS) certificate and offers both fraud and chargeback prevention services.

Benefits of taking ACH payments

Increasing your available payment options will help with customer acquisition. Plus, why not contain a pricing strategy that offers a discount for ACH payments? You can too increase your turn a profit margin thank you to time savings and lower fees.

i. Faster processing times

The ACH payment processing time will be faster than paper checks thanks to its hands-gratis process, which also includes not having to brand a trip to the bank to brand a deposit. The typical turnaround time is 3-5 days, simply a solar day or 2 slower than credit card transactions.

2. Lower processing costs

Despite being a bit slower to process than credit cards, ACH transaction fees can be considerably cheaper. For case, credit menu transactions take two associated fees: a pct of the full amount (1.5% to three.five%) besides as a processing fee of $0.10 to $0.30.

For ACH payments, nonetheless, at that place will typically exist either a flat fee of $0.xx to $1.50 per transaction or just a percentage fee of effectually 0.5% to ane.5%.

3. More anticipated revenue

Processing time and fees aside, the other big advantage of ACH payments is the anticipated revenue from recurring payments.

That is, you don't have to worry when — or if — customers will send you a monthly payment. Instead, your sales forecasting will be much more authentic, based on when each ACH transfer will be deposited in your business relationship. Remember, all the same, that PCI compliance volition be critical to avoid unnecessary fees.

In addition, some providers volition have an ACH merchant cash advance option, which allows you to receive a cash accelerate without having to apply for a loan. That mode, you tin can access money during your slow flavor and then repay information technology when business picks upwards again.

Incorporate ACH payments into your business organisation

If ACH payments are a good fit for your business, there'due south no time like at present to set up this choice as office of your sales and marketing efforts. Not only will it give customers an additional payment method in your sales process, but you'll likewise have potentially lower transaction fees and a more predictable acquirement stream.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may take an involvement in companies mentioned.

How To Set Up Ach Payments For Business,

Source: https://www.fool.com/the-blueprint/ach-payment/

Posted by: kingperep1992.blogspot.com

0 Response to "How To Set Up Ach Payments For Business"

Post a Comment